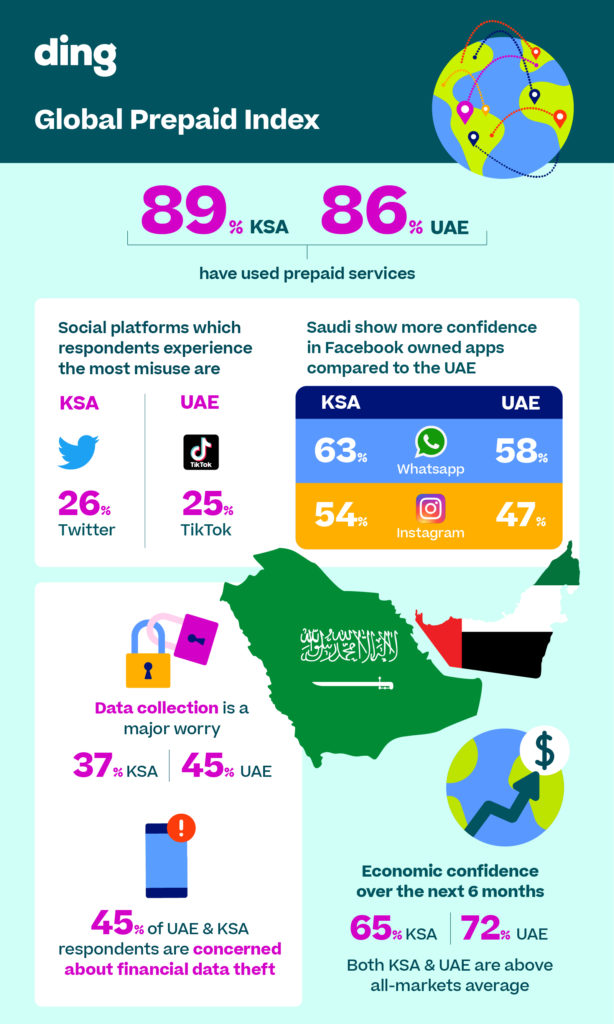

- Two in five respondents in UAE and KSA say having financial data stolen is their main worry

- 45% of UAE respondents fear data being collected, 37% in KSA

- 75% of UAE respondents say they have low trust in social media platforms

Dubai, United Arab Emirates – November 2, 2021: Ding, the fastest way to send international mobile top-up, today launched the second Ding Global Prepaid Index (GPI)in the United Arab Emirates and Saudi Arabia. Consumers in the GCC are among the world’s most avid users of social media but concerns over data use and misuse of platforms remains high according to the Ding GPI.

This bi-annual global study commissioned by Ding, the world’s largest mobile top-up service, examines the views of 6,250 respondents across the KSA, UAE, Nigeria, Indonesia, Germany, India, Mexico, Brazil, and the Philippines, regarding their engagement in the prepaid market and their attitudes towards the economy. The study found that GCC is one of the largest users of prepaid products with 89% (KSA) and 86% (UAE) of those surveyed claiming to operate in this economy.

Trust in Data Collection and Social Media Platforms

Almost half (46%) of respondents in the UAE cited data collection as a major worry, followed by 45% concerned about financial data theft. The results were similar in KSA at 39% and 47% respectively, showing issues of data protection weigh heavily on these Middle East populations in spite of major social media penetration and phone use in both markets.

Comparatively, the Philippines showed the highest fear of illegal data collection (63%) and Germany the least (32%). Conversely, Nigeria showed the biggest fears of financial data being stolen (60%) and India the least (38%).

UAE respondents expressed the least trust in social media, coming 8th in the survey while Indonesia was first, with 88% confidence in platforms versus 75% in the UAE and 78% KSA. The UAE is least trusting in social media when compared to other markets but only 25% don’t trust the social media they use.

Negative experiences on social media platforms

Misuse or online abuse appears across platforms though there are variations from country to country as to consumer concerns. Respondents in the UAE witness or experience more misuse on TikTok (25%) than most other markets and on LinkedIn, the level is double the average seen in other markets (12%).

In Saudi, respondents cited more misuse on Twitter (26%) and Snapchat (20%) than any other market. However, it was found that respondents felt there is less misuse on Facebook (30%) than most other markets – 12% lower than the average.

This Saudi confidence is reflected in the uptake of Facebook owned apps such as WhatsApp (63%) and Instagram (54%) compared to lower numbers found in the UAE where figures were just 58% and 47% respectively. In fact, the UAE has one of the lowest numbers of Instagram (47%) and FB/Messenger (43%) users compared to other markets.

“The GPI findings across the board are very insightful as they show that even if the UAE and KSA share many market similarities, the experience consumers have online directly impacts their trust,” said Mark Roden, Founder & Chief Executive of Ding. “While the UAE and Saudi have some of the Index’s best results for online safety, the issue has become a global concern and with the recent issues we have seen across social media and spyware revelations, these fluctuations in trust are very much in line with a global trend.”

Economic Confidence

With regard to current economic confidence, the UAE is 15% above the all-markets average. Interestingly, when comparing the confidence levels from GPI 2 to the original Global Prepaid Index launched in early 2021, confidence levels are down 3% on average. Saudi confidence levels are 10% above the all-markets average.

When looking at the economy over the next 6 months, the UAE is the most confident (at 72%) of all countries surveyed. This may be due to the excitement generated by the launch of Dubai Expo 2020. The Saudi respondents came third in the rankings at 65%.

***ENDS***

About the Ding Global Prepaid Index (GPI)

The Ding Global Prepaid Index (GPI) is a major bi-annual survey analysing the prepaid market. The second GPI shines a light on the growing appetite among people across the socio-economic divide for consumer goods or services in the Prepaid economy. The survey gathered insights from 6,250 respondents from across Europe, Asia, and the Americas regarding their use of prepaid offerings, examining their attitudes, activities and outlook for the future.

About Ding

Ding was founded to improve people’s lives by helping those with less gain access to more. As the number one international mobile top-up service in the world, Ding has been keeping people connected since 2006, when it launched this first-of-a-kind service. Today, Ding’s users have successfully sent close to a half a billion top-ups globally, via the app, online at Ding.com, and via over 8,000 partners, and over 600K retail outlets. DingConnect.com is the leading top-up API provider & online portal for businesses that want to offer prepaid products as a compliment to their existing website, app and retail outlets. Ding delivers a top-up every second, via 550+ operators, across 140+ countries – helping families and friends around the world to stay connected.