After a year where the world stood still, the inaugural Ding Global Prepaid Index explored consumer confidence, trends in mobile consumption, and global responses to the pandemic – particularly among those participating in the prepaid economy. The report is based on more than 7,000 responses from Europe, the US, South America, the Middle East and Asia, including 3,000 expat workers, who would traditionally feature as regular participants in the prepaid market.

What is prepaid?

The prepaid market has been defined as people who use prepaid mobile phones or financial products prepaid, such as prepaid Visa cards, or prepaid utility bills, or gift cards / vouchers prepaid.

Prepaid mobile consumption & data trends:

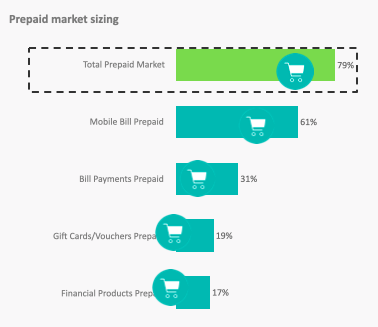

Through the pandemic, the prepaid sector has thrived as users worldwide enjoy the freedom and flexibility it offers; 79% of global respondents have at least one touchpoint with the prepaid market, 45% use two or more. As well as being sizable, the prepaid market is inclusive; all demographics and life stages measured interact with the prepaid ecosystem in some form.

Prepaid mobile bills account for the highest usage (61%), followed by prepaid utility bills (31%), prepaid vouchers and gift cards (19%) and prepaid financial products such as a prepaid visa card (17%).

When it comes to preference of prepaid to bill pay options for phone usage, Western nations such as the US, the UK and France are more likely to use bill pay than prepaid mobile at a rate of 32%, 43% and 34% respectively. Prepaid phone usage is most common in Indonesia (83%), the Philippines (83%), Brazil (78%) and in the Gulf (76%).

While many assume that the prepaid market primarily serves those in a lower income bracket, the study has revealed that a high number across all income brackets engage in prepaid services. This result is relatively high across the board, with 84% of higher income using prepaid, followed by 78% of low-income earners and 79% of medium-income earners. Financial prepaid products such as prepaid debit cards and virtual cards are actually used significantly more by medium and high-income earners. E.g. prepaid cards 9% usage low-income earners, 13% medium-income earners and 22% for high-income earners.

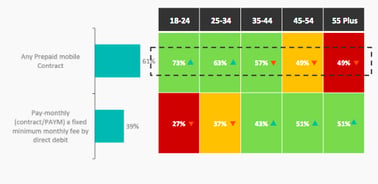

The engagement with prepaid services seems to decrease with age while bill pay usage seems to increase with age. 73% of 18-24 year olds have a prepaid mobile contract, compared to 49% in the 55 and over age bracket. When it comes to paying a fixed monthly fee or being on a contract, just 27% of those at 18-24 year olds yet over 50% are over the age of 55.

While expats are more likely to use prepaid options than the wider population, both groups have a strong preference for cash. Some 17% of respondents use prepaid cards, with the highest proportions in Brazil, the US, and the Gulf. Cash and prepaid cards are preferred because it helps people budget.

Overall, 85% of those surveyed still choose cash as their preferred payment method. When asked why, 43% stated that it is merely a preference, and 32% stated it helps them to better budget and control their spending. Similar results were seen when asked about those who prefer to use prepaid debit cards, with 28% stating it was just a preference and 25% referring to budgeting.

Expatriate workers from less developed countries also use the prepaid market to support unbanked friends and families in their home countries. Among expatriates, some 36% send prepaid credit to stay in contact; 33% as it makes them feel happy to send; 32% do so to keep the receiver happy; 32% because the receiver needs it urgently; 27% send as it is their responsibility to do.

Around 53% of consumers have sent/received airtime. In non-Western regions, airtime transfer is common but still reaches 30%+ in the UK and France. It’s a two-way street for most – 60% both send and receive airtime.

"It’s an incredible service where we can top up our families and friends’ mobile phones, when they live in remote parts of the world – Muhannad in the Middle East"

Tech trends:

The increase in mobile phone usage during the pandemic has been well documented, but one surprising development is the demand for a super app akin to China’s WeChat and the Middle East’s Careem. Around 53% say they would use such an app with demand highest in Indonesia (71%), Brazil (70%), the Philippines (69%) and Saudi Arabia (67%). The US (30%), the UK (38%) and France (41%) are the least interested. While super apps are convenient and versatile, combining online messaging, retail, and service bookings, stricter data protection laws in Europe and the US may stymie efforts to develop them, which could explain the interest level comparisons.

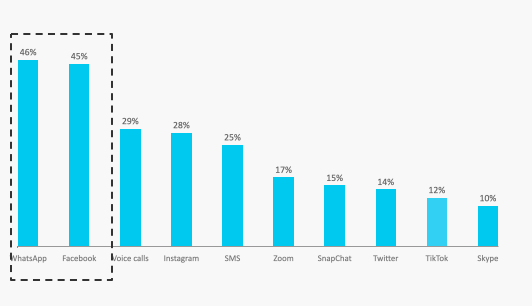

Zoom was by far the most popular video conferencing app with 17% saying they use it compared to 10% for longstanding alternative Skype. The app has become a stalwart of both business meetings and catch-ups with friends during lockdowns and the move to working from home.

WhatsApp and Facebook are the most popular apps in the social media and messaging world with 46% and 45% of respondents respectively, stating they use these tools to stay in touch during the pandemic. This is followed by old fashioned standard voice calls at 29%with Instagram just a few places behind at 28%. Since WhatsApp, Facebook and Instagram are all owned by Facebook, it’s safe to say Mark Zuckerberg’s influence over the social media world is remaining for now. Just 12% of respondents mentioned the up-and-comer app TikTok. The rest of the top 10 most popular communication tools were SMS (25%), Snapchat (15%) and Twitter (14%).

Consumer Confidence and Outlook

The data revealed that consumer confidence is higher among prepaid users. When compared to the Global Consumer Confidence Index, which is at 52.1, Ding’s Global Prepaid Consumer Confidence Index sits at 55.1, with those in the prepaid ecosystem having a slightly more positive outlook on current and future events.

The responses from both expats and the wider population demonstrate resilience: despite the impact of Covid-19 on the global economy, consumer confidence is high across most demographics – though less so among expatriates who have been disproportionately impacted by travel bans. Covid has had an outsized impact on expat’s ability to travel for work or come home for holidays, this may explain lower optimism among this group. Some 93% of expats who use prepaid services have sent or received remittances.

Overall 55% of people are optimistic about the economy over the next 6 months, 19% are pessimistic. However, for prepaid users, 59% are optimistic and 16% are pessimistic. When broken down by country, the US (46%), the UK (35%) and France (39%) are most pessimistic about the economic outlook and Gulf nations are most optimistic (61%).

Regarding overall confidence regarding their employment or work situation, 62% are optimistic and 12% are pessimistic. For prepaid users this is again slightly higher where 63% are optimistic and 11% are pessimistic. The US (52%), the UK (49%) are also the most pessimistic here. But interestingly enough, France and Gulf Nations are equally optimistic of their employment situation (55%). Could be due to the support of France’s welfare system.

57% are optimistic about their families income and 15% are pessimistic. The US (50%), the UK (45%) and France (57%) again are the most pessimistic. Indonesia and the Philippines are most optimistic (both 70%) both nations where supporting the family is of high importance.

When it comes to budgeting priorities, for the wider population, rent, food, family and mobile phones/connectivity are the top priorities. However, for expat workers, family is the top priority. The biggest concern for those in the US, the UK and France is rent. In Brazil, Indonesia and the Philippines, groceries are the biggest budget concern. Indonesia also places more importance on budgeting for education, and the Philippines places more importance on supporting their families.

Additional findings – COVID-19

Amidst the prepaid market findings, the survey also revealed opinions toward trust in governments handling the COVID-19 pandemic as well as people’s opinions toward the vaccine.

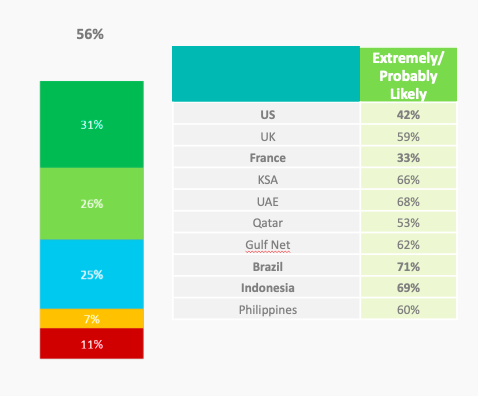

The study has shown that vaccine hesitancy is higher in countries where citizens have the luxury of choice, whether that be choosing to take the vaccine, or being able to engage in safe practices such as social distancing or working from home. Brazil (71%) followed by Indonesia (69%) are the most likely nations to take the Covid-19 vaccine, with participants in France expressing a shockingly low percentage of 33% vaccine acceptance, followed by the US at 42% compared with 62% in the Gulf and 71% in Brazil.

"I have many friends around the world and I like to keep in touch with them online or on the phone. Ding is like a gift, it allows me to keep my friends in my life."

When asked about their opinion on the vaccine, for 32% of respondents the most importance is placed on ensuring those that need it most, get it first, this is followed by 31% of people only wanting to take the vaccine if it is properly tested.

Other interesting findings related to opinions on the vaccine were that 30% feel the vaccine is great news for the world and just 28% believe the world will get back to normal after the vaccine. 10% of respondents believe the world had a vaccine all along and this is just part of their plan and 18% are worried the government will use the vaccine as a way to further control the public. 14% are also concerned they won’t be able to afford the vaccine with the Philippines being the most concerned nation.

78% feel Covid-19 is the most serious crisis we have faced in recent times. Similar results were observed when comparing countries with freedom of press and trust in their government. France, the UK, the US and Brazil score the lowest when it comes to their belief that their respective governments are doing all they can to handle the crisis.Confidence in government handling of the crisis is strongest in KSA, the UAE, Indonesia and the Philippines. This shows a potential correlation between countries with high freedom of press (also freedom of disinformation), and a lack of trust in their governments, as well as and a higher trust in government in countries with limited press freedoms.

About the Ding Global Prepaid Index (GPI)

The Ding Global Prepaid Index (GPI) is a biannual survey analysing the prepaid market, this wave of research is the first instalment of the study. The GPI shines a light on the people who may see prepaid products and services as their only option to live in the world today. A total of 7000 respondents were surveyed across Europe, Asia and the Americas regarding their use of prepaid offerings, examining the attitudes, activities and outlook of the forgotten billion in particular during the Covid-19 pandemic. Those surveyed were evenly distributed across gender and aged over 18, thirty per cent of the sample also identified as expats.